The energy landscape in Czechia as in Europe is undergoing a historic transformation. For investors and businesses alike, understanding this shift—and acting on it—is increasingly essential. Renewable energy, once a niche concern, is now front and center in Europe’s economic strategy.

To understand why this matters and how Czech investors can take advantage of the change, Expats.cz spoke with Jan Stránský, Wealth Manager at finance and investment firm WOOD & Company.

What exactly is renewable energy?

“Renewable energy refers to power sourced from natural processes that are constantly replenished—and therefore sustainable over time,” Stránský explains. The most common forms include:

- Solar power – Capturing sunlight via solar panels

- Wind power – Harnessing the wind with turbines

- Hydropower – Using flowing water or dams

- Biomass – Burning organic matter such as wood or agricultural waste

- Geothermal – Tapping heat from below the Earth’s surface

Unlike fossil fuels, these sources don’t deplete finite resources or emit as much CO2. That makes them a cornerstone of future energy systems—and increasingly, of investment portfolios.

What is the European Green Deal, and how does it affect Czechia?

The European Green Deal is the EU’s flagship plan to make the continent climate-neutral by 2050. But it’s about more than reducing emissions.

“It’s also a roadmap for transforming Europe’s economy,” says Stránský. “It aims to make industries more competitive, buildings more efficient, and supply chains more sustainable.”

Key goals include:

- Cutting greenhouse gas emissions by 55 percent by 2030

- Accelerating investment in renewable energy and clean transport

- Introducing a carbon border tax on emissions-heavy imports

- Promoting biodiversity and a circular economy

Where does Czechia stand?

The Czech Republic has historically relied on coal and nuclear power. But change is underway.

In 2023, the Czech Republic’s energy mix consisted of 36 percent coal, one-third nuclear, 17 percent renewables—mainly hydro and biomass—and 13 percent natural gas. Coal use has declined significantly compared to previous years, while solar and wind are on an upward trend.

The country is now legally bound to meet the EU’s climate neutrality targets. This means major sectors—especially manufacturing, real estate, and energy—face new challenges and incentives.

“There’s significant pressure on Czech industry to decarbonize,” says Stránský. “But there’s also significant support. The EU is offering billions in funding for green investments.”

Indeed, through the Recovery and Resilience Facility (RRF), the Czech Republic is set to receive around EUR 7 billion, much of which will fund clean energy and digital transformation.

What does this mean for real estate and construction?

The Green Deal is reshaping the property sector. Developers now face stricter energy efficiency standards, such as nearly zero-energy building rules and mandatory energy performance certificates

“This is triggering a wave of retrofitting,” Stránský explains. “Old buildings are being upgraded to meet new standards—and that’s creating opportunities in solar panels, insulation tech, and smart building systems.”

Investing in the (renewable) future

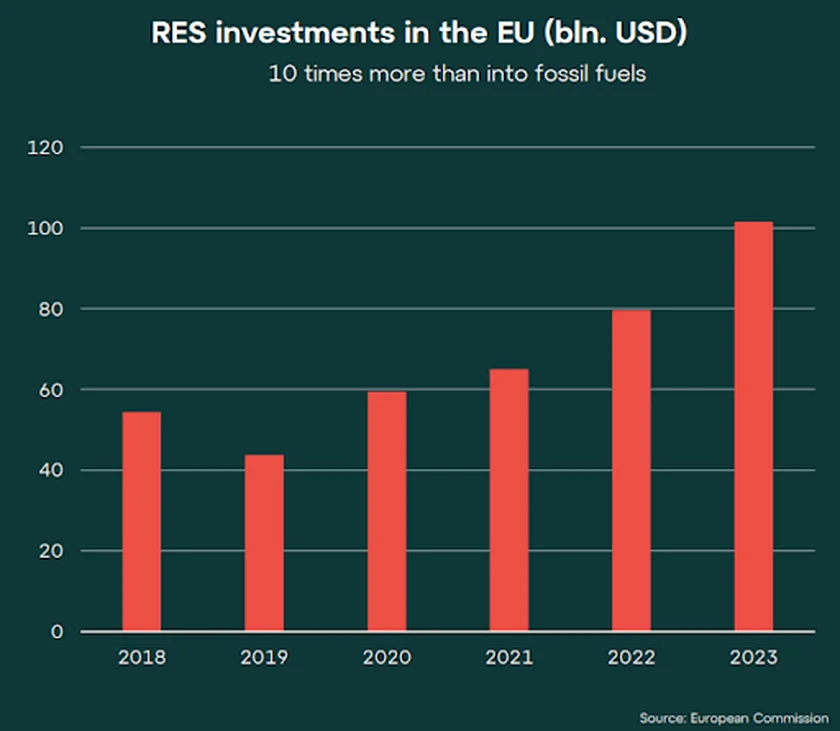

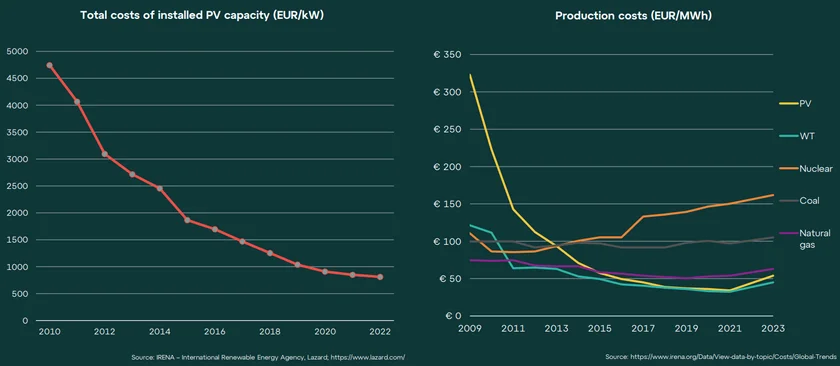

For investors, the transition is opening up new avenues for growth. European capital markets are shifting toward projects that meet ESG (Environmental, Social, Governance) standards. Green bonds, EU grants, and financing from the European Investment Bank are fueling developments in solar energy, battery storage, and clean tech.

WOOD & Company is helping its clients navigate—and benefit from—this shift.

Our Renewables Fund is one of the few domestic options giving Czech investors direct exposure to the sector,” says Stránský. “Since launching in June 2024, we’ve already funded the construction of a new 42 Megawatt peak solar plant in Romania and are currently investing in a battery storage facility in Sweden.”

The fund has delivered a 9.25 percent return in its first seven months, with a projected annual return of about 15 percent.

If you're interested in aligning your investments with the future of energy—and potentially unlocking strong returns—now is the time to act.

Should you want to reach out to Jan Stránský at WOOD & Company directly for a free consultation, he can be reached at jan.stransky@wood.cz.

Disclaimer: Trading financial instruments carries risks. Always ensure that you understand these risks before trading.